Introduction

The rise of online transactions has increased the need for strong security measures. 3-D Secure plays a crucial role in keeping online payments safe. But, do we really understand the basics of this security system? From where it started to how it works today, this article aims to simplify the fundamentals of 3-D Secure, explaining its importance in making digital financial transactions and payment processing more secure.

3DS: Global Growth, Enhanced Security, and Financial Institution Preferences

3DS serves as a widely used communication protocol among banks and card networks, each having its own branded programs and rule structures.

According to Datos Insights Report (https://www.outseer.com/datos-cnp-fraud/), the expansion in the quantity of distinct merchant IDs initiating transactions through 3DS rails is surpassing the year-over-year growth rate of the overall 3DS transaction volume. Globally, the total count of merchant IDs utilizing 3DS witnessed a 33% increase from the first half of 2022 to the first half of 2023. Within regulated markets such as Europe and Australia, where 3DS protects up to 50% of card-not-present (CNP) transactions, the incidence of fraud is three to six times lower compared to overall card-not-present transactions.

Moreover, half of the financial institutions surveyed indicate a preference for 3DS over other CNP fraud controls they have in place. This choice is based on factors such as the inclusion of enhanced data not present in the authorization message, the utilization of risk-based assessments through machine learning (ML) models, and the capability for user authentication.

The Basics of 3-D Secure

3-D Secure operates as a sophisticated security protocol, augmenting the safety of online credit and debit card transactions. Serving as an additional protective layer, the term "3-D" encapsulates the collaboration among three essential domains: the merchant/acquirer, the issuer, and the interoperability.

- Merchant/Acquirer Domain: - This is the online store or shop where you make a purchase. It's like the platform that takes your payment and checks with your bank to make sure everything is okay.

- Issuer Domain: - This is the bank or company that gave you your credit or debit card. They're in charge of making sure it's really you making the purchase and deciding if the transaction is approved or denied.

- Interoperability Domain: - This is like the messenger between the store (merchant) and the bank (issuer). It makes sure they can talk to each other smoothly, exchanging information and making sure everything is secure during the transaction.

How Does it Work?

The protocol utilizes XML messages sent over SSL connections with client authentication, ensuring the authenticity of both parties — the server and the client — through the use of digital certificates.

- XML (eXtensible Markup Language): XML is a versatile and human-readable markup language designed to store and transport data. It uses tags to define elements, making it easy to create and share structured information between different systems.

- SSL (Secure Sockets Layer): SSL is a cryptographic protocol that ensures secure communication over a computer network, typically the internet. It provides a secure connection by encrypting the data transmitted between a user's web browser and a website's server. When engaging in a transaction via Verified by Visa or SecureCode, the process involves redirecting to the card issuer's website for authorization.Commonly a password linked to the card is entered during online purchases. Presently, it is common to send a one-time password via SMS text messages or emails for authentication, particularly during enrollment and password recovery.

Is the System Worth it? Advantages and Disadvantages Compared

Advantages for Merchants:

- Enhanced Security: The use of 3-D Secure adds an extra layer of security to online transactions, reducing the risk of fraud and unauthorized access.

- Reduced Chargebacks: With increased authentication, merchants may experience fewer chargebacks related to unauthorized transactions, shifting some liability to the card issuer.

- Consumer Confidence: The implementation of 3-D Secure may boost consumer confidence in the security of the online shopping process, potentially increasing sales.

Disadvantages for Merchants:

- Integration Challenges: Implementing 3-D Secure may require adjustments to the existing payment processing system, leading to additional development costs and complexities.

Advantages for Clients:

- Increased Security: Clients benefit from an additional layer of security, reducing the likelihood of unauthorized transactions and identity theft.

- Liability Protection: In cases of fraudulent transactions, clients may experience increased protection and reduced liability, with the liability often shifting to the card issuer.

Disadvantages for Clients:

- Inconvenience: The additional steps in the authentication process can be perceived as inconvenient, leading to potential frustration for clients during the checkout process.

Upon careful consideration of the heightened security, reduced chargebacks, and enhanced consumer confidence provided by 3-D Secure for merchants, coupled with the increased security and liability protection it affords clients, the advantages overwhelmingly support the adoption of 3-D Secure. While integration challenges may exist, the robust security features and positive impact on both merchants and clients make the implementation of 3-D Secure a worthwhile investment in fortifying online transactions.

Transaction Cloud's 3-D Secure Solutions

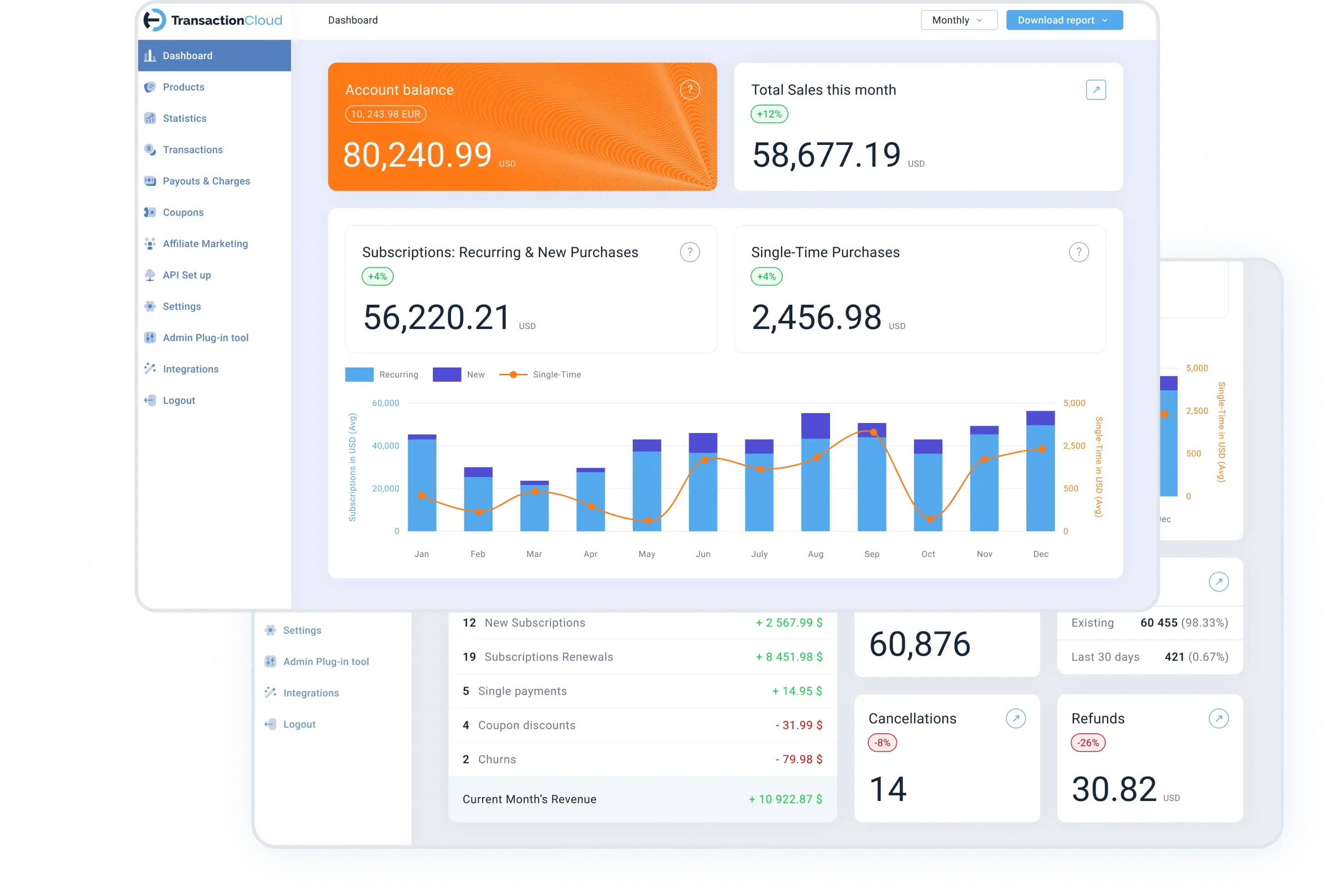

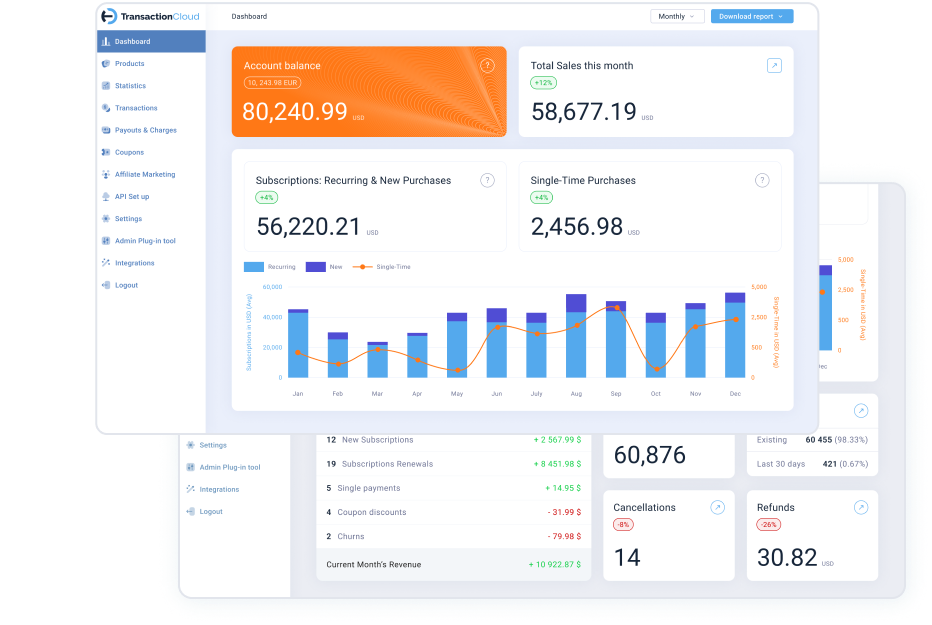

Transaction Cloud revolutionizes online transaction security, offering vendors powerful 3-D Secure methods with seamless integration and valuable insights. Here's a concise overview:

Real-time Authentication:

Immediate, real-time verification for every transaction, minimizing the risk of unauthorized activities. This includes checking databases of stolen cards as a way of avoiding chargebacks.

Flexible Integration:

The integration is not needed, as the option is included in Transaction Cloud’s offer. 3-D secure is turned on for all transactions that allow it - by default.

Detailed Transaction Insights:

Access to comprehensive transaction histories and analytics empowers vendors to assess the effectiveness of 3-D Secure measures. Vendors can easily check which transaction was protected with 3-D secure.

User-friendly Experience:

Prioritizing a positive user experience, Transaction Cloud ensures a smooth authentication process for customers during checkout. In essence, Transaction Cloud's 3-D Secure solutions offer vendors a secure, streamlined online shopping experience, safeguarding transactions while providing flexibility and insights.

Conclusion

In summary, 3-D Secure is a sophisticated protocol that ensures the integrity of digital payments, balancing enhanced security with user experience. While challenges like integration exist, the advantages for both merchants and clients make the adoption of 3-D Secure a compelling investment. Transaction Cloud's 3-D Secure solutions elevate the game, offering real-time authentication, seamless integration, and detailed transaction insights. This proactive approach eliminates integration hurdles for vendors while providing a comprehensive overview of protected transactions.

The adoption of 3-D Secure, especially with innovative solutions like Transaction Cloud's, promises a secure future, where robust security measures coexist with a seamless user experience.