Sales Tax, VAT, GST, HST, QST, PST all are taxes on sales of product but with different names across different countries.

From tax point of view, it doesn't matter if you have a physical presence in any of the countries you are selling in, you are still responsible to know the sales tax laws of those countries. You are responsible to register, calculate, issue invoice as per the requirements of law, collect, file and remit taxes to the government. Moreover you have to always be ready for audits, answering questions from tax authorities and retaining invoices for at least 10 years. You can't use the excuse of not knowing the law of the country or not having resources to do so. Simply speaking, not complying with sales tax laws is breaking the law and is considered tax evasion. Penalties can range from severe fines to arrest warrant.

Even if these penalties don't happen now they can happen anytime in future, credit card companies are obligated to share records of transactions to local governments. An ordinary citizen can report about a business not collecting sales taxes to the tax authority. Only way to remove the sales tax liability for the company, its owners and management team is to fully comply.

Here are some examples of penalties for sales tax evasion,

| Jurisdiction | Penalties |

|---|---|

| United States of America | Imprisonment |

| United Kingdom | Imprisonment |

| European Union | Fines |

| Canada | Fines |

| Australia | Imprisonment |

| India | Imprisonment |

| Japan | Fines |

| Saudi Arabia | Imprisonment |

| United Arab Emirates | Imprisonment |

In addition to the legal aspect, there are two practical business aspects to consider:

-

If you want to raise capital for your SaaS company or sell the company to an investor in the near future sales tax / VAT compliance is very important; as no investor would want to acquire or invest in a ticking time bomb.

-

With regards to growing and expanding the business; customers know you are a legitimate business, they get peace of mind while making the purchase when they see sales tax being collected. It's just that customers see tax being collected on every purchase and when they don't see you charging that they automatically think this product is a scam.

Simply speaking there is no other alternative but to comply with sales tax, VAT, GST laws.

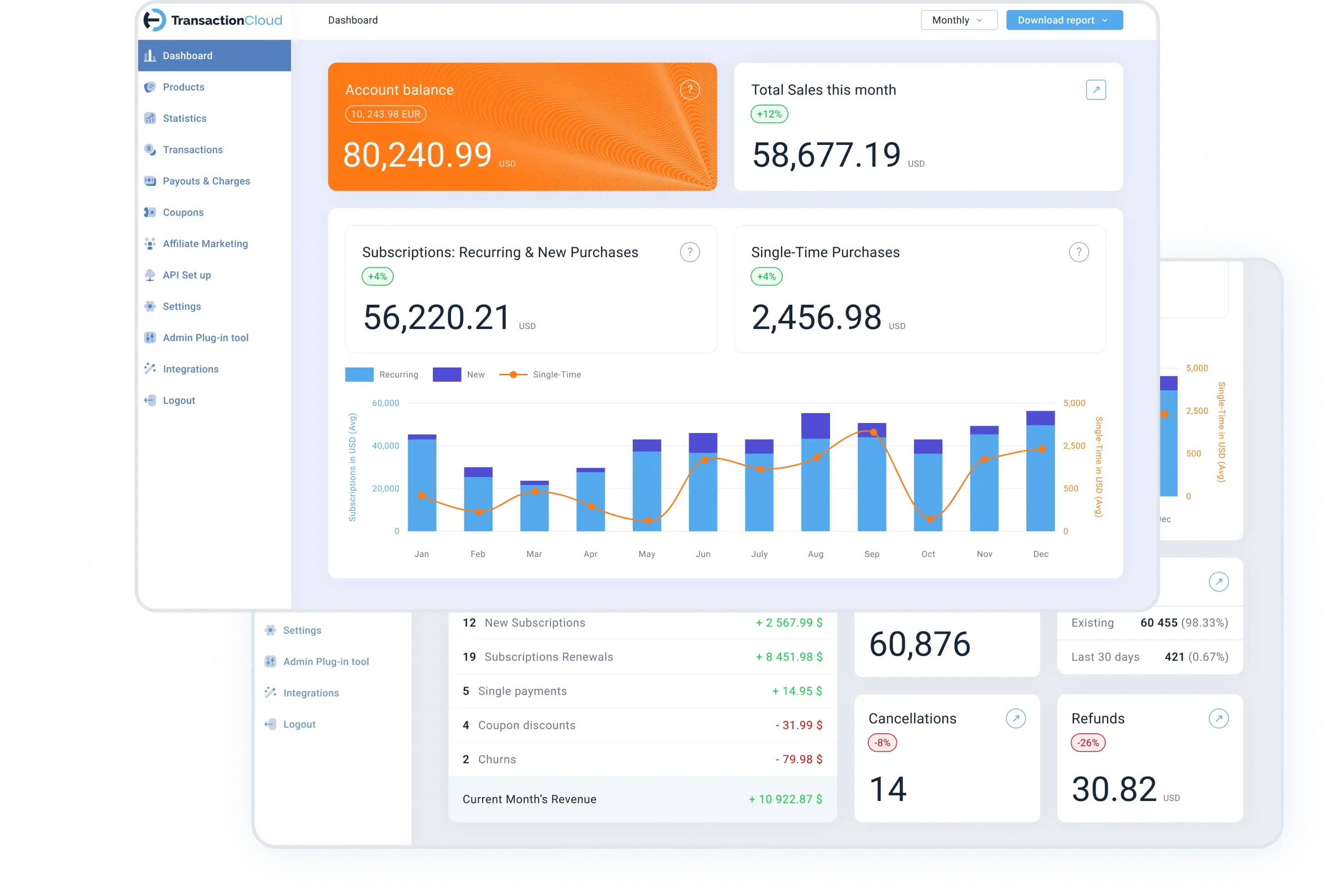

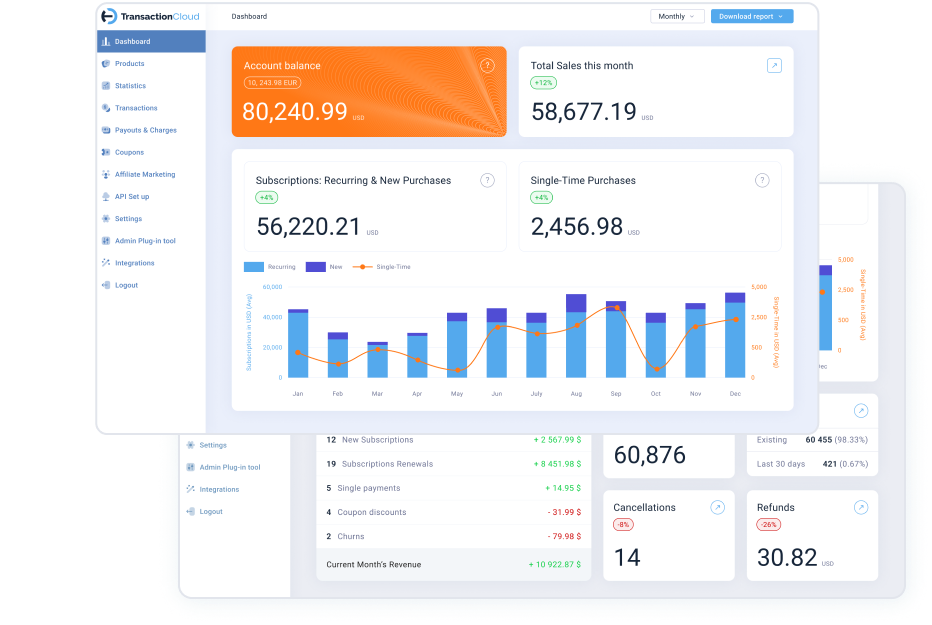

Transaction Cloud makes it easy for you to sell globally while being compliant. When you sell through Transaction Cloud's platform we are the merchant of record and are legally liable to do everything that the sales tax laws require. In conclusion, our platform fully automates the sales tax process for a SaaS / digital products company. In addition there are more features in the platform that will reduce your development and ongoing admin & maintenance work. Contact us now to learn more.