As the digital economy continues to grow, businesses that sell software as a service (SaaS) and other digital products are facing increasing challenges when it comes to paying taxes. One of the biggest challenges is the complexity of Value Added Tax (VAT) and sales tax regulations, which can be confusing and difficult to navigate.

VAT is an indirect tax applied to the value added during the production and distribution of goods or services. In most countries, businesses that sell goods or services must register for VAT and collect the tax from customers. The amount of VAT collected is then paid to the government, minus any VAT the business has already paid for goods or services it has purchased.

The complexity of VAT arises from the fact that the tax rate is determined by the location of the customer, not the location of the business. This means that businesses that sell digital products must determine the VAT rate for each customer and file a VAT declaration every quarter in each country where they sell their products. The number of possible combinations of tax rates and customer locations can be overwhelming, making compliance with VAT regulations a significant challenge for SaaS and digital product businesses.

In addition to VAT, many states in the United States have their own sales tax regulations, which can be just as complex as VAT. Each state sets its own sales tax rate, and some states have local sales taxes as well. This makes it difficult for businesses to determine the correct sales tax for each transaction, and to ensure that they are paying the correct amount of tax.

The complexity of sales tax and VAT regulations can be a barrier to businesses that want to sell their products globally. It can also consume significant time and resources for businesses that are trying to comply with these regulations. However, there is a solution to this problem.

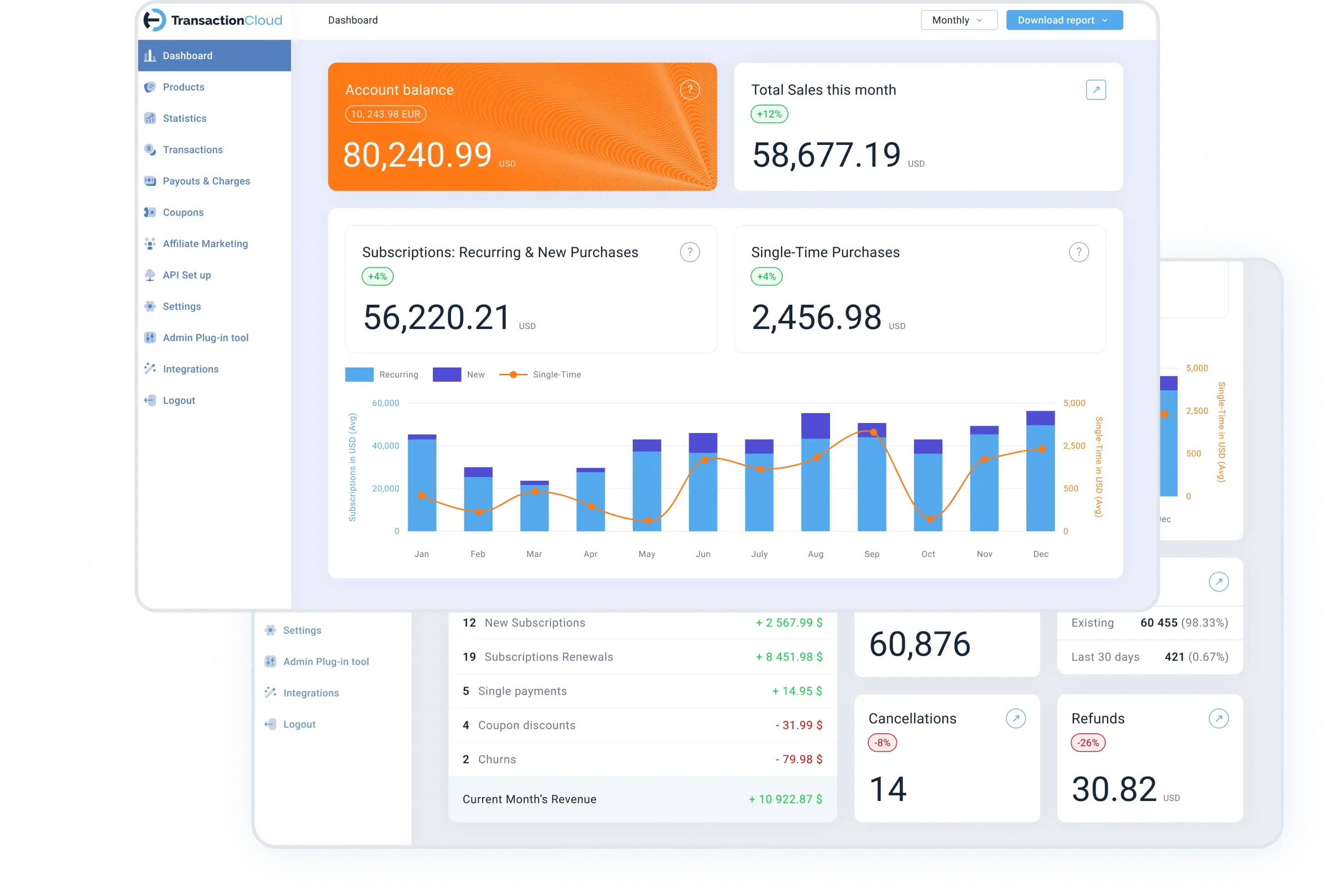

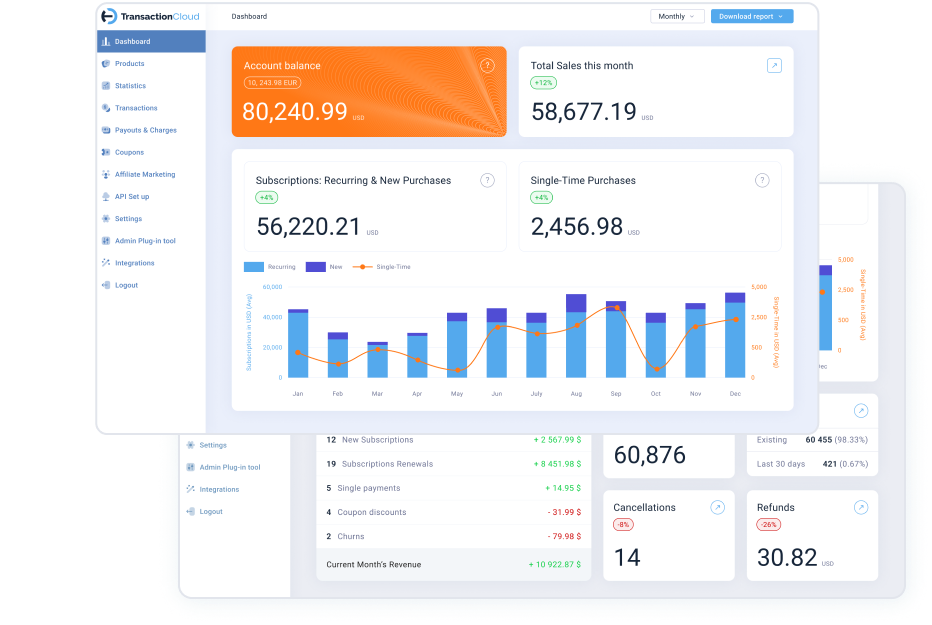

Using a payment platform like Transaction Cloud can simplify the process of paying sales tax and VAT for SaaS and digital product businesses. As an authorized reseller, Transaction Cloud can handle billing, sales tax calculation, and payment processing on behalf of businesses, freeing them from the burden of complex taxation. By managing their entire business through Transaction Cloud, businesses can simplify their bookkeeping, reduce the time and resources they spend on tax compliance, and focus on selling their products legally and successfully.

In conclusion, the complexity of sales tax and VAT regulations for SaaS and digital products is a significant challenge for businesses in the digital economy. However, by using a payment platform like Transaction Cloud, businesses can simplify their tax compliance and focus on growing their business.