A Snapshot: Merchant of Record vs. Payment Provider Services

In the world of online business, choosing how to manage transactions is crucial. The choice between a Merchant of Record (MoR) and a payment provider has far-reaching effects on operations, compliance, customer experience, and growth. To help you decide, this table compares what each option offers. It's a guide to understanding the roles of MoR and payment providers, so you can make the right choice based on your business goals.

| Aspect | Merchant of Record (MoR) | Payment Provider |

|---|---|---|

| Role and Responsibility | Legal, financial, and compliance responsibilities, as well as technical aspects of online transactions. | Handles only technical aspects of online transactions |

| Global Expansion | Managing local currency conversions. | Businesses need to navigate complex tax and compliance issues themselves. |

| Customer Experience | Localized payment methods, currencies, and languages. | May lack the same level of localization customization. |

| Compliance | Stays updated with regulations, ensuring transactions align with local laws. | Businesses need to independently address complex compliance obligations. |

| Fraud Prevention and Security | Fraud detection tools and strategies to safeguard both businesses and customers from cyber threats. | Prioritizes secure transactions, but might not offer the same level of fraud prevention measures as a MoR. |

| Financial Management | Manages revenue recognition, ensuring precise financial reporting. | Responsibility for revenue recognition and reporting lies with businesses. |

| Operational Efficiency | Streamlines operations by handling various responsibilities, enabling businesses to focus on growth and innovation. | Simplifies technical payment aspects, but might not address broader operational intricacies in international transactions. |

Advantages of Choosing a Merchant of Record

-

Global Expansion Made Easy: For businesses eyeing international markets, navigating the labyrinth of tax laws, regulations, and compliance requirements can be a daunting task. A MoR simplifies this by managing local currency conversions, tax calculations, and ensuring adherence to local laws. This not only reduces operational complexities but also enhances customer trust.

-

Enhanced Compliance: As governments tighten their grip on online transactions, compliance becomes paramount. A MoR stays updated with evolving regulations, ensuring that your business is always on the right side of the law. This minimizes the risk of penalties and legal complications, allowing you to focus on your core competencies.

-

Optimized Customer Experience: MoRs offer a unified shopping experience, regardless of the customer's location. By providing localized payment methods, currencies, and languages, they enhance customer trust and satisfaction. Payment providers, while crucial, might not cover the full spectrum of customer needs in this regard.

-

Fraud Prevention and Security: A MoR employs advanced fraud detection tools and strategies to protect both the business and customers from cyber threats. This holistic approach encompasses both technical and financial aspects, providing a comprehensive layer of security.

-

Streamlined Financial Management: Revenue recognition, especially in international transactions, can be intricate. MoRs handle this process efficiently, ensuring accurate financial reporting and minimizing the risk of errors that could impact your bottom line.

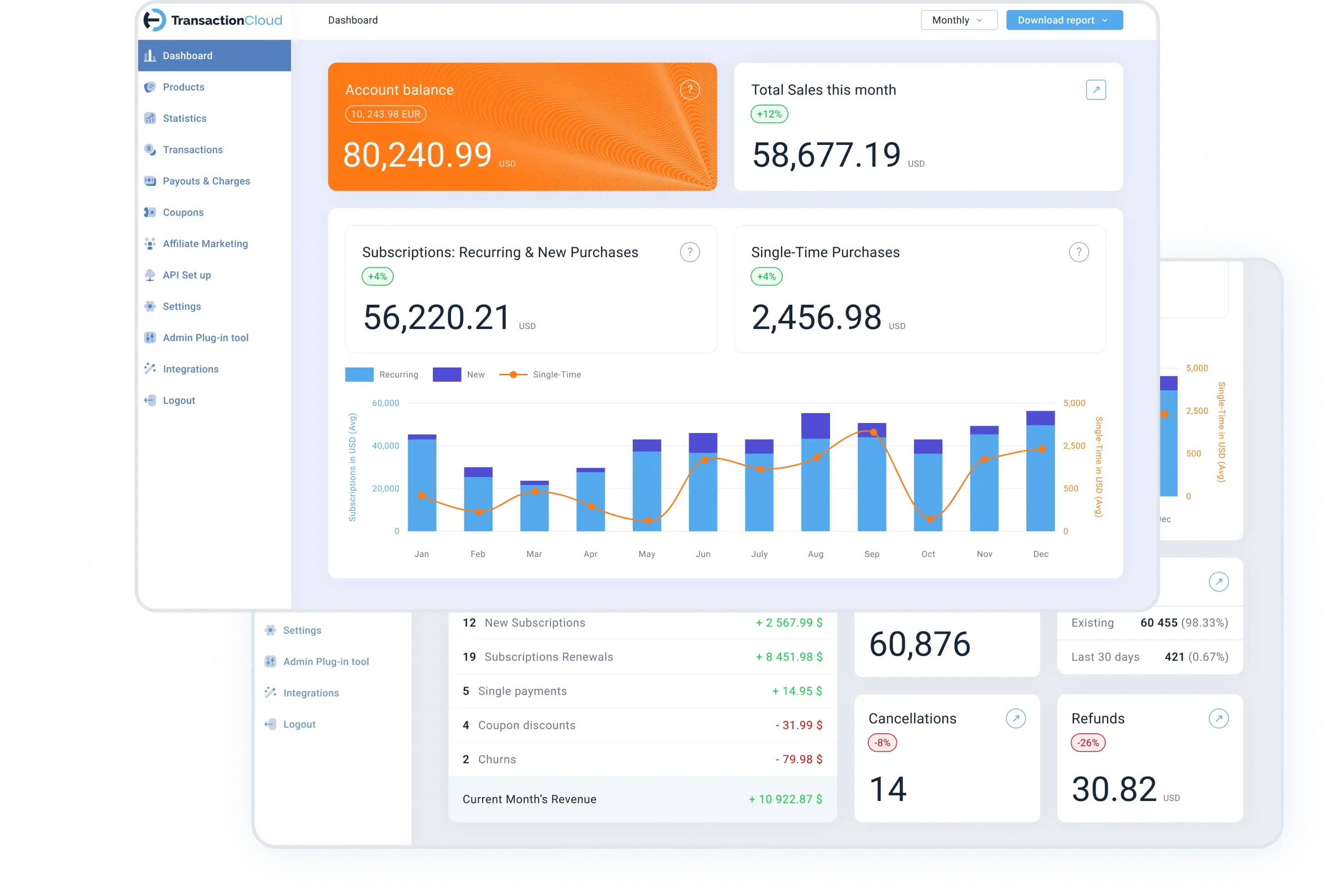

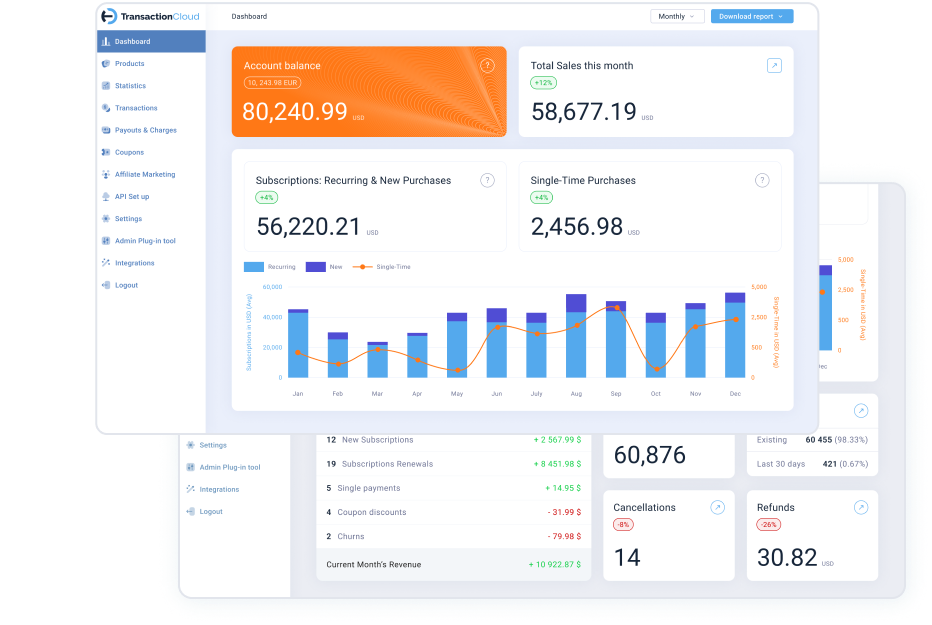

Why do business owners choose Transaction Cloud over popular payment processors?

While popular payment processors offer a wide range of services, it is limited to technical aspects. As a Merchant of Record, Transaction Cloud will handle all tax liabilities for you, so you can focus on business growth. With TC, you don’t have to register, calculate, file, remit and respond to queries from various tax jurisdictions.

Transaction Cloud is the only payment platform with affiliate marketing management, automatic monthly payouts to affiliates, and fraud prevention in affiliate’s commission based on sales, refunds, chargebacks.

Payment Service Provider only handles payment processing.

- Low initial fee includes only payment processing.

- Multiple additional fees for local payment methods, different currencies, fraud prevention, recurring billing, invoicing etc. Addition of all the critical features that your business needs will easily double the initial fee.

- You will still be directly responsible for sales tax compliance in all jurisdictions.

- A closer inspection of individuals' transactions usually reveals significant differences in what vendors are paying as fees.

Merchant of Record has more features than a payment provider including payment processing and taking full liability for sales taxes.

- Transaction Cloud is an all-in-one platform, where the flat per transaction fee covers all the features of the platform.

- Broad range of payment methods, localization, seamless purchasing experience and customized branding will accelerate conversion and boost your business growth.

- As your Merchant of Record we are directly responsible for collecting, filing, and remitting sales taxes.

The Future-Proof Choice

As businesses continue to embrace digital transformation, the choice between a Merchant of Record and payment providers becomes pivotal. While payment providers offer essential technical support, a Merchant of Record stands out for its comprehensive, all-encompassing approach. By shouldering the legal, financial, and compliance burdens, a MoR empowers businesses to focus on growth, innovation, and a seamless customer experience. This strategic move not only streamlines operations but also future-proofs your business against the challenges of a rapidly changing e-commerce landscape. So, if you're looking to elevate your online business to new heights, choosing a Merchant of Record is unquestionably a smart move.