What is SaaS

Digital tools and services make work and communication of modern people easier. But development and support of software products is quite time-consuming, expensive and burdensome. Sometimes in order to update the software or refine its functionality big companies organize entire technical departments and hire relevant specialists. Smaller businesses most often can’t afford this level of software maintenance.

Software as a service or SaaS is a brilliant solution to this problem. This is a model where software acts as a service and SaaS vendor as a provider of it. On the SaaS platform users get access to the service via the Internet. In this case the software is placed on the developer's server, which ensures its functionality, regular refinements and updates. Accordingly, access to it can be obtained regardless of location. This significantly expands the capabilities of both — SaaS vendors and users — even at international level.

Difficulties with SaaS Accounting

When SaaS vendors sell their services to users, this involves financial flow which requires measurement and processing. SaaS accounting has its own specifics, but international SaaS accounting has even more of them.

When SaaS vendors sell globally, they have a numerous amount of customers on a daily basis. These customers are coming from different tax jurisdictions and pay in a different currency.

Thereby, the vendor needs to account for all of these currencies, do the invoicing according to legal requirements and answer questions from tax authorities. Also, the vendor constantly needs to hedge for foreign exchange fluctuations.

Multiple currencies and multiple customers from different tax jurisdictions require a very conversant accounting. And SaaS companies need an efficient method to cope with it.

How does Transaction Cloud Simplify SaaS Accounting

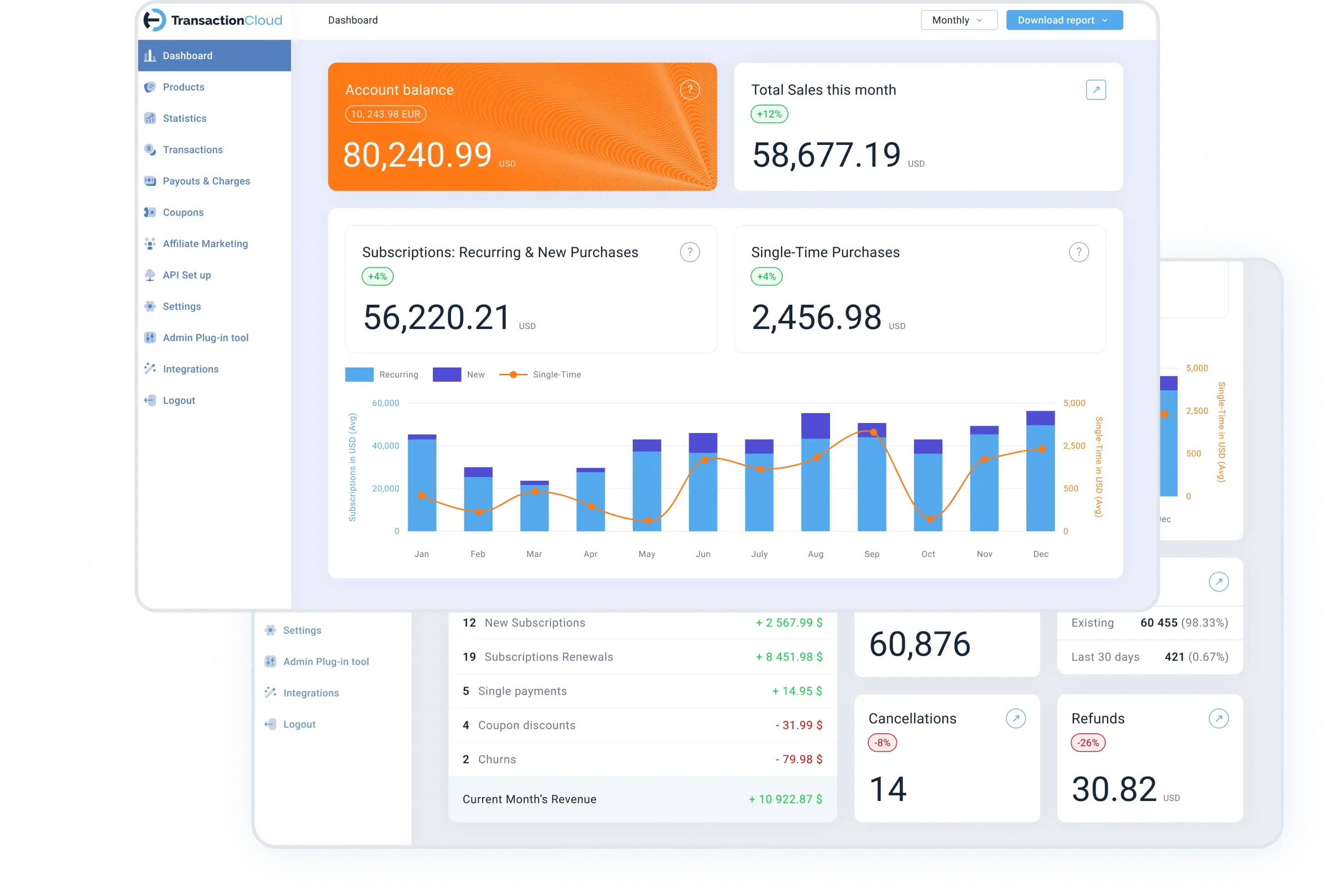

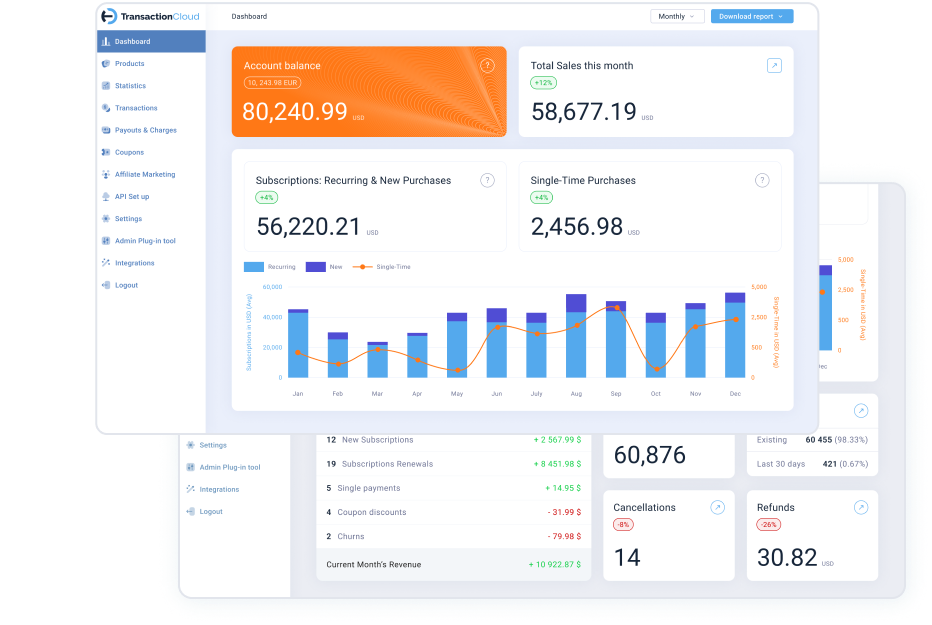

Transaction Cloud is the platform with embedded tools which simplifies SaaS accounting, making it more convenient and profitable for vendors.

There is no need to have an a la carte approach — only one integration and the vendor gets a full set of features which help with invoicing, sales tax compliance and affiliate marketing, fraud prevention and chargebacks.

Invoicing

International invoicing can be very challenging at least for several reasons:

In some jurisdictions it is common to display the local currency on the invoice. This rule applies even to foreign companies. For example, in Poland the payment amount and the taxes has to be displayed in zloty, in the UK — in pounds, in China — in yuan.

Sometimes there are requirements for retention of invoices. In some tax jurisdictions it is legally required to store all the invoices for 10 years, so that tax authorities can audit those invoices and relevant tax filings.

With the assistance of Transaction Cloud SaaS companies don't have to accomplish this by themselves — the platform automatically takes care of this function.

Sales Tax Compliance

Tax systems of different countries are very specific and complex. Moreover the tax requirements are constantly changing. It is not easy to stay up to date with these changing requirements without expending valuable time and resources.

For example,

- In the European Union every country has a different tax rate.

- In the US every postal code has its own tax rate and there are more than 50000 of them in the country.

- In Canada tax rates in different provinces have their own names: GST, HST, QST, PST.

All of these cases are different, but combined by one common thing — sales taxes are one of the biggest sources of income for each government. Hence, the authorities are very critical and very vigilant about any sales tax issues. So SaaS companies need to be very careful, accurate with their requirements and be up to date about specifics of all tax jurisdictions they do business in. It requires a lot of administrative work and is quite burdensome.

Transaction Cloud platform does sales tax compliance automatically.

This platform is compliant with more than 100 tax jurisdictions and follows all the legal requirements for tax purposes.

When a SaaS vendor sells through the platform, Transaction Cloud becomes the seller of record for the end customer. Hence Transaction Cloud is responsible to calculate, collect, register, file, remit and answer queries from tax authorities. This significantly reduces the accounting and administrative burden for a SaaS vendor.

If a customer is not supposed to pay any sales tax, Transaction Cloud takes care of validation and removes the taxes. If the customer is supposed to pay the taxes, the platform collects and retains all the information required by the tax authorities.

Affiliate Marketing

One more important question for SaaS companies in their activities is how to promote their products and services at minimal cost.

For a SaaS company one of the best ways to market its product is via affiliate marketing. With the power of affiliate marketing, the company can reach target customers using an army of affiliates around the world. When a sale happens, the affiliate receives the agreed commission.

A lot of famous, successful ecommerce companies, for example, Amazon, use affiliate marketing in their operations. Partly because it does not result in recurring fixed costs. Affiliate marketing is a variable expense — if the business goes down, the costs decrease proportionally.

The challenge comes when a SaaS company has hundreds or thousands of affiliates. Each of these affiliates have to be tracked along with how much sales and which customers they bring. The company has to calculate their commission, display it and pay them out. It is a lot of accounting work and it has to be done manually by somebody.

Transaction Cloud solves this problem and simplifies accounting for its vendors. Integration with the platform automatically brings access to all the affiliate marketing functions, and the company can efficiently onboard, track and pay different affiliates.

Based on the schedule and the commission rates the platform automatically pays affiliates. If there is a refund, generated for a sale that was brought by an affiliate, the platform automatically deducts its commission. Affiliates also have the ability to see their earnings by accessing their own accounts.

Vendors who use Transaction Cloud don’t need to click thousands of buttons. With the platform they can reap all the benefits of affiliate marketing without having to manage affiliate marketing and its accounting by themselves. Moreover, there is no extra integration required to use affiliate marketing features.

Fraud prevention and chargebacks

Sometimes fraudulent customers can file chargebacks. Chargebacks are expensive for multiple reasons. Whenever there is a chargeback, not only the value of the transaction has to be refunded, but there is also a $20-30 charge on top of it. There is no way to avoid this charge once a fraud happens. The only way to do this is to prevent it in advance.

Transaction Cloud uses its proprietary AI based algorithms to track the customer’s behavior while they are purchasing. Based on that the platform can identify fraudsters and prevent them from purchasing.

Also, Transaction Cloud utilizes real time updated databases from various card networks. As soon as a card is reported as stolen, Transaction Cloud’s platform already has that information and can stop that stolen card from being used on the platform.

This reduces the cost of chargebacks and administrative costs which come with chargebacks.

Costs saved by Transaction Cloud

SaaS vendors are aware about the pros of accounting software: how much it eases their sales process, helps to conduct affiliate marketing, and do SaaS accounting. But it involves a lot of work from an integration point of view. Even if integration with accounting software is done, there is substantial amount of work that still has to be done manually by accountants.

With Transaction Cloud's platform a SaaS company can save on the work of professional accountants. For example, rather than use a team of 2 or 3 accountants for the bookkeeping, and reconciliation, a medium-sized SaaS company can do its accounting with the help of one part-time accountant.

With Transaction Cloud nobody needs to:

- manually enter information about hundreds of affiliates;

- generate hundreds or thousands of invoices;

- track all of legal requirements and currency rates;

- hedge against fx fluctuations

Simply speaking, Transaction Cloud’s platform saves accounting costs in the short and long term and helps in rapidly scaling up SaaS business. It was created with SaaS vendors’ interest in mind. It is the best friend of SaaS companies which are trying to simplify SaaS accounting and grow their sales. It ensures secure, robust service and keeps costs under control.