Introduction

In the ever-evolving world of Software as a Service (SaaS), a significant aspect that demands continual attention is cybersecurity. As SaaS businesses handle sensitive user data, including payment information, the importance of ensuring robust security measures is paramount. This article explores the significance of cybersecurity in SaaS payment systems and provides strategies for strengthening it.

Why Cybersecurity Matters in SaaS Payment Systems

SaaS payment systems process sensitive financial information on a recurring basis. This places a critical responsibility on SaaS providers to protect customer data from ever-present threats like data breaches, identity theft, and fraud. A single security incident can tarnish a company's reputation, lead to significant financial losses, and impact customer trust.

Key Cybersecurity Challenges in SaaS Payment Systems

-

Data Breaches: These occur when unauthorized individuals gain access to confidential data. The potential damage from data breaches can be catastrophic, including financial losses and brand damage.

-

Phishing Attacks: These attacks use disguised emails or other communication mediums to trick recipients into revealing sensitive information.

-

Denial-of-Service (DoS) Attacks: In a DoS attack, hackers overload a network or service with traffic, rendering it inaccessible to users.

-

Payment Fraud: Payment fraud can range from unauthorized transactions to more sophisticated forms of fraud like card testing.

Building a Robust Cybersecurity Framework for SaaS Payment Systems

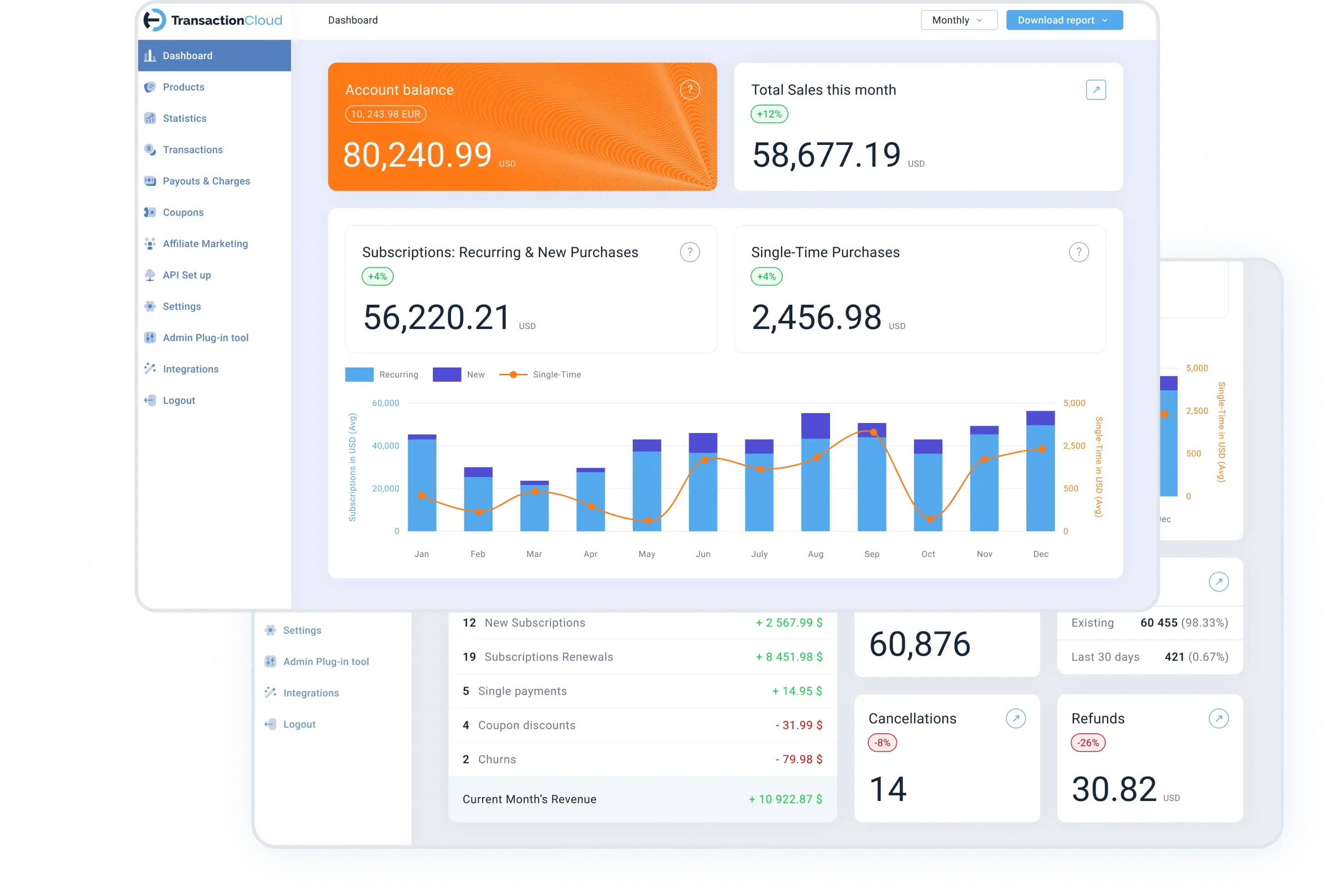

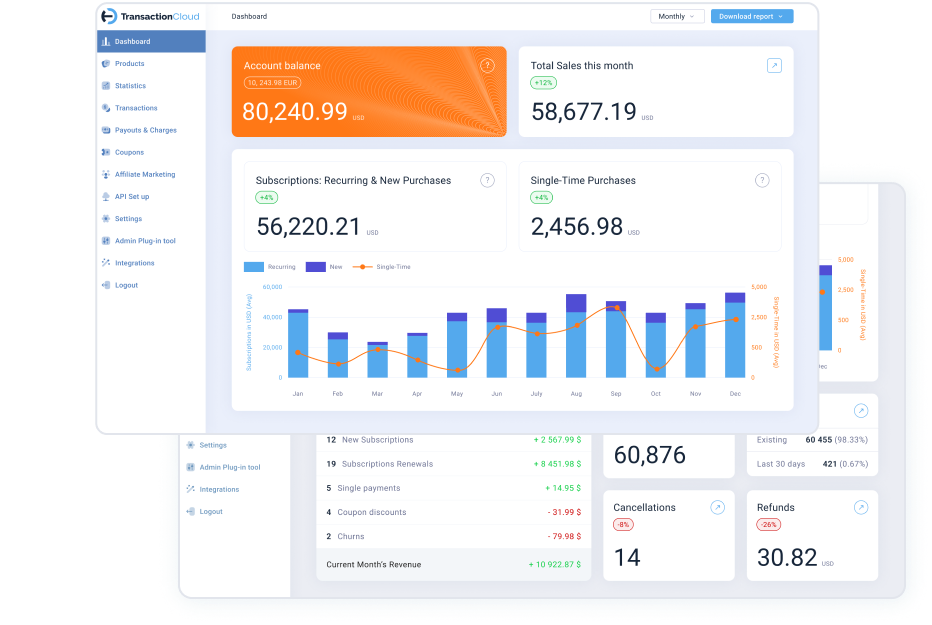

Building a robust cybersecurity framework involves a combination of strong security policies, cutting-edge technology, and continuous monitoring. Here are a few key strategies that Transaction Cloud uses to ensure the security of our clients:

-

Adherence to Security Standards: Transaction Cloud adheres to security standards such as the Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation (GDPR). These standards provide guidelines for protecting sensitive payment information.

-

End-to-End Encryption: Encryption transforms data into a format that can only be read with a decryption key. Transaction Cloud ensures that data is encrypted both in transit and at rest.

-

Periodic vulnerability scans: Vulnerability scanning is a critical process aimed at pinpointing potential security loopholes and vulnerabilities within systems and the software they operate on. Transaction Cloud proactively embraces this procedure, scanning for any potential weaknesses within the software.

-

Fraud detection using AI: Transaction Cloud’s fraud detection involves the implementation of AI-based algorithms to identify and proactively prevent fraudulent individuals, ensuring their transactions are thwarted.

-

Minimizing chargeback costs: Real-time access to card network databases with stolen or lost card information in Transaction Cloud lowers false positives, increases approval rates, and improves conversion rates. This enhanced security streamlines payment processes and enhances the customer experience.

Conclusion

Cybersecurity is non-negotiable for SaaS providers, especially those handling sensitive payment data. By prioritizing cybersecurity, SaaS companies can safeguard their reputation, build customer trust, and ensure their growth in the increasingly digital and interconnected business landscape. With the proper security measures in place, Transaction Cloud continues to deliver innovative, user-friendly, and secure payment solutions for its users.