Here is a situation, you and your team worked countless hours to research, conceptualize, develop, and test a cutting-edge SaaS product. Your SaaS product is ready to be marketed and solves a critical problem around the world for numerous customers. You start marketing your product and find that there is a lot of demand.

Hopefully, before it is too late you realize the complexity of selling globally. If not, you could be setting yourself up for severe fines in various legal jurisdictions. Selling globally is much more complicated than developing a SaaS product and accepting online payments from customers.

Many companies have learned this the hard way.

Sales tax, VAT, GST, (QST, PST, etc.) consequential income tax laws are complicated. You need to have resources to accurately calculate, collect, and reimburse the taxes to various government entities. Besides, you have to fill out various forms and file taxes by the due dates around the world. In countries such as the USA, there is no national sales tax, but sales tax rates differ from county to county. There are 3006 counties in the USA! Even in countries like France tax rates differ from metropolitan areas to places such as Corsica and overseas territories.

You have to worry not only about paying sales tax, VAT, etc. but also there are consequential corporate income taxes for the revenues that you generate in a particular jurisdiction. The taxman doesn't care if you are a domestic company or an international company without any physical nexus. In addition, there are privacy laws, changing payment industry standards & regulations that you have to worry about. Failure to collect and pay taxes or stay compliant with various regulations can result in severe penalties.

Do you have internal resources available to take care of the challenges listed above?

You have three options:

- Hire employees who are subject matter experts in the problems listed above

- Outsource to various experts to take care of these issues

- Get an Authorized Reseller

Wouldn't you rather keep your company lean?

Wouldnt you rather focus on marketing your SaaS product, improving it, increasing customer satisfaction, and rapidly growing your business?

An authorized reseller is responsible for accurately calculating, collecting, filing, and paying Sales Tax, VAT, etc. to various government entities by their respective due dates. Moreover, the consequential corporate income tax from merely doing business in an international country is the Merchant of Record's responsibility. Needless to say, your company is still responsible to pay corporate income taxes in the country & province where it is incorporated. Since the reseller handles private, sensitive information about your customers, it is responsible for complying with privacy laws, payment industry standards, and regulations.

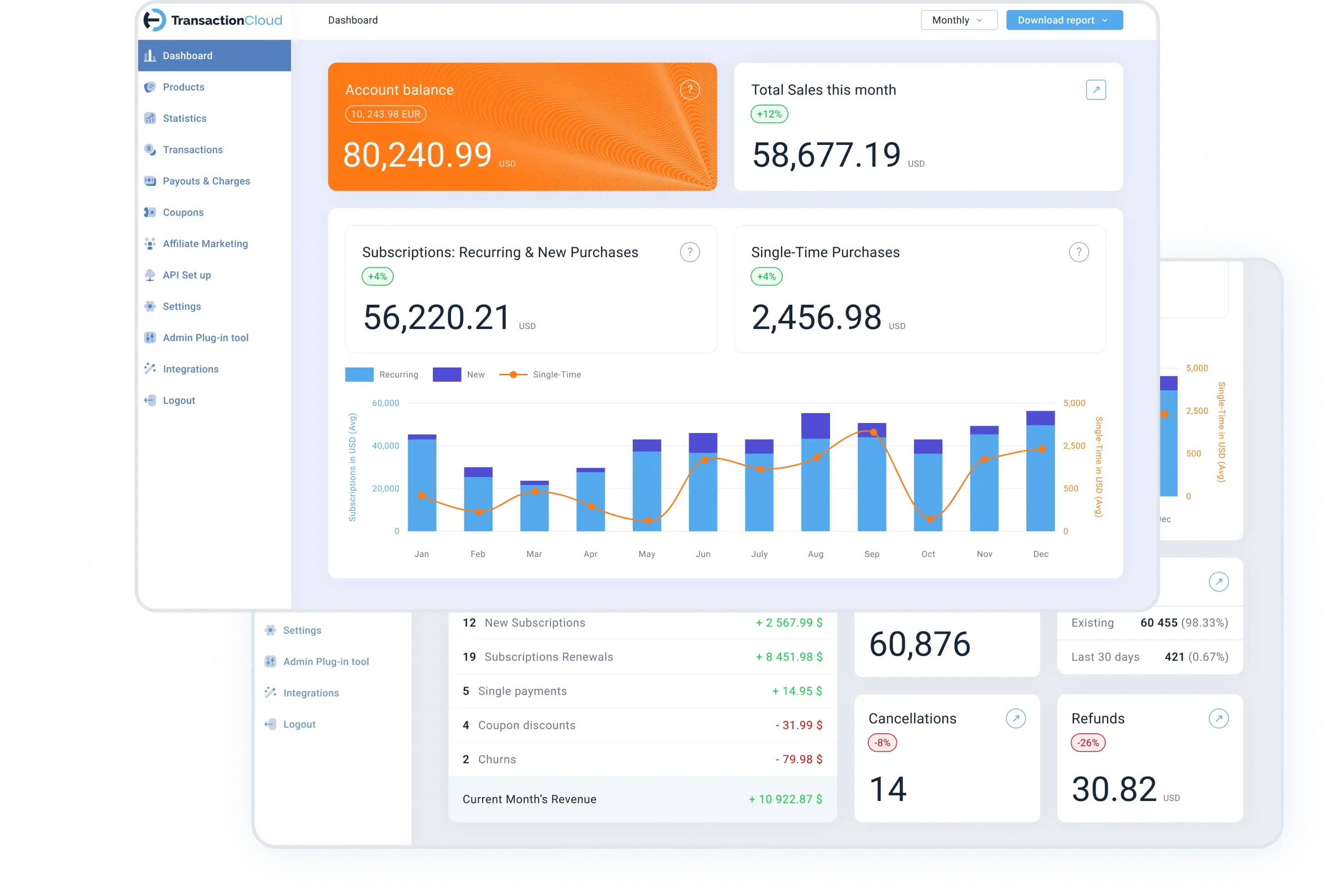

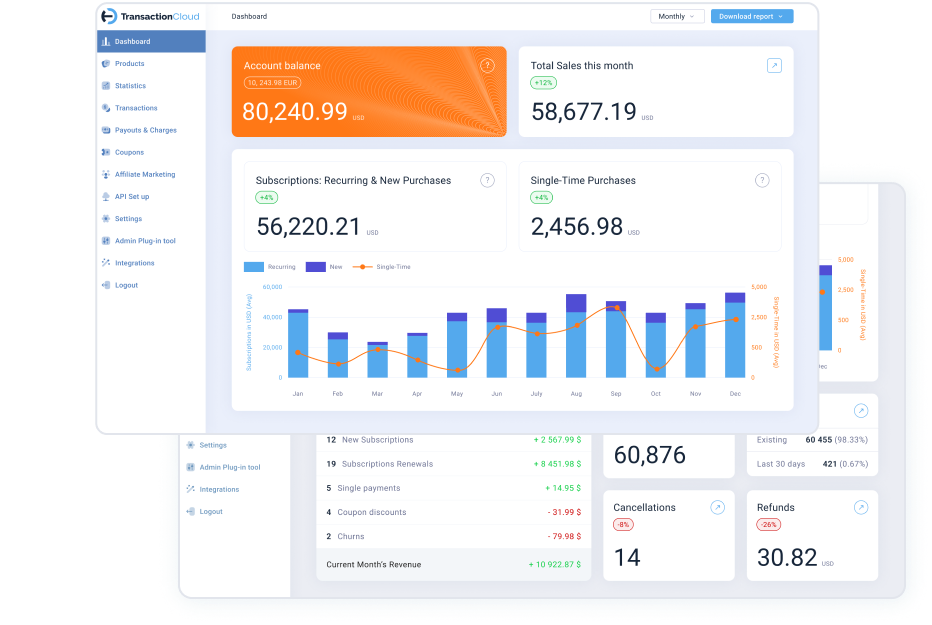

When you partner with Transaction Cloud, we become your non-exclusive reseller. With us, you will receive the most affordable, transparent, and responsive solution. We are your all-in-one-partner and we share the passion of rapidly growing your business.